The Impact on Our Community

Why This Affects Every Resident

Northern Township is at a turning point. In the weeks ahead, a judge will decide whether large parts of our community are annexed by the City of Bemidji or whether we move forward together by incorporating as the City of Northern.

This decision will affect every property owner in the Township — not just those in the annexation area. If Bemidji annexes about 30% of our tax base, it will shrink the pool of properties sharing costs. That puts upward pressure on the taxes of everyone who remains

Taxes: The Key Difference

Tax Rate

10-year Total

Property Taxes Paid

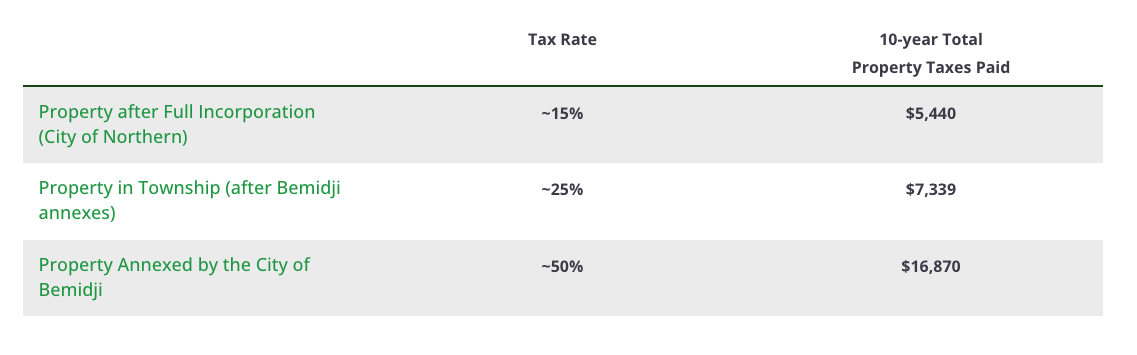

Property after Full Incorporation (City of Northern)

~15%

$5,440

Property in Township (after Bemidji annexes)

~25%

$7,339

Property Annexed by the City of Bemidji

~50%

$16,870

Bottom line:

Bemidji’s city tax rate is nearly triple Northern’s and is expected to climb. Annexation also would take about 30% of our tax base without any substantial reduction in expenses.

In contrast, incorporation allows us to keep our rate close to today’s level because we are not creating new departments or adding unnecessary services.

NOTES

A higher tax rate results in a higher Township tax payment. For this analysis, our financial consultants compared projected taxes on an average owner-occupied single-family home in Northern Township. The average assessed market value used is $312,600, with an assumed 2% annual increase in market value.

Taxes: The Key Difference

Bottom line:

Bemidji’s city tax rate is nearly triple Northern’s and is expected to climb. Annexation also would take about 30% of our tax base without any substantial reduction in expenses.

In contrast, incorporation allows us to keep our rate close to today’s level because we are not creating new departments or adding unnecessary services.

NOTES

A higher tax rate results in a higher Township tax payment. For this analysis, our financial consultants compared projected taxes on an average owner-occupied single-family home in Northern Township. The average assessed market value used is $312,600, with an assumed 2% annual increase in market value.

Unlocking New Opportunities

Incorporation Brings State Aid

Equally important, upon approval by the state legislature, incorporation makes us eligible for Local Government Aid (LGA) — money the State of Minnesota pays only to cities. This is not a one-time grant. It is permanent, annual funding of about $450,000 per year that will flow directly to our community.

That state aid will never arrive if we remain a township. With incorporation, Northern will have the ability to invest more in the things residents care about most, like safer and better-maintained roads, while still keeping one of the lowest tax rates in the region.

What’s at Stake

Both annexation and incorporation are legally available paths under Minnesota law. But the outcomes are not equal.

Annexation

Higher Taxes

No state aid if remain a Township

Decisions made in Bemidji City Hall

Incorporation

Lower Taxes

New revenue for roads and services

Local Control - Decide our own future

Help Shape Our Future

Your participation is critical. When the judge considers this case, she will weigh not only financial and legal evidence but also the clear preference of residents. By showing that our community supports incorporation, we can secure a future that is both fiscally responsible and locally controlled.

📅 Public Hearing

Tuesday, September 30, 2025 – 6:00 p.m.

Beltrami County 4H Building

The choice before us is stark but simple: annexation takes more from our residents and gives less back, while incorporation protects our pocketbooks, strengthens our roads, and keeps Northern’s future in Northern’s hands.

Stay Informed

If you have questions, please reach out. We’re committed to transparency and will keep publishing updated numbers as more information becomes available. Check our website for the most current information.